Simplifying the EB-5 Investment Amount: how much you really need to invest

Invest for Your Future: Understanding the EB-5 Visa and Visa Process

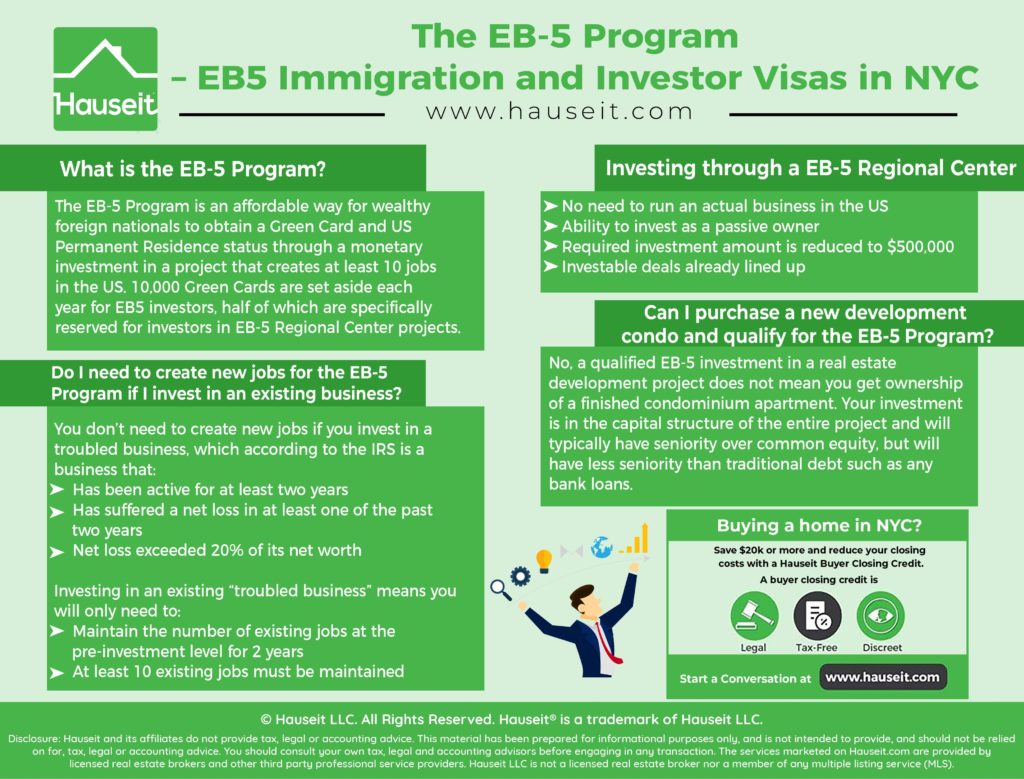

The EB-5 Visa program presents an engaging opportunity for foreign financiers looking for U.S. irreversible residency via strategic investments that promote job production - EB-5 Visa by Investment. With a minimal financial investment limit of $800,000, this program not only facilitates the financier's migration process however additionally adds to the broader economic landscape. However, maneuvering via the complexities of qualification requirements, financial investment alternatives, and the application timeline can be complicated. Understanding these aspects is important for making educated choices that could considerably influence your future, yet numerous prospective candidates continue to be uninformed of the subtleties entailed

Review of the EB-5 Visa

The EB-5 Visa program provides a special path for foreign financiers seeking long-term residency in the United States. Established under the Migration Act of 1990, this program aims to boost the U.S. EB-5 Investment Amount. economic situation with funding investment and task development. Capitalists who certify can get a visa for themselves and their instant household participants by spending a minimum of $1 million in a brand-new industrial venture or $500,000 in a targeted work area, which is specified as a country location or one with high unemployment

The EB-5 Visa not just assists in accessibility to long-term residency however also enables financiers to participate in a dynamic industry. By preserving or creating at the very least ten full time tasks for united state workers, the investor can accomplish one of the vital demands of the program (EB-5 Visa by Investment). The investment can be made straight in a service or through an assigned Regional Facility, which handles the investment procedure and task development in behalf of the capitalist

Eligibility Demands

To get the EB-5 Visa, financiers have to fulfill certain qualifications and comply with prescribed investment quantities. These demands are developed to guarantee that candidates contribute significantly to the united state economic climate while likewise boosting job production. Recognizing these eligibility requirements is essential for possible financiers looking for long-term residency via the EB-5 program

Investor Qualifications

Financier qualifications for the EB-5 visa program are essential in figuring out qualification for participation in this pathway to permanent residency in the United States. To certify, an investor needs to be a foreign national who is willing to buy a brand-new business that develops tasks for U.S. employees.

The capitalist has to show that they have the requisite capital, which can be sourced from authorized methods. Additionally, the financier's funds need to go to risk, indicating they can not be assured a return on their investment. This requirement highlights the requirement for dedication to the venture.

Additionally, the capitalist has to be actively associated with the management of the company or have a policy-making function, guaranteeing that they are contributing to the success of the business. Importantly, the investor has to additionally satisfy the minimum age demand of 21 years.

Finally, it is important for investors to verify that their financial investment straightens with the EB-5 program's geographic and financial standards, especially if purchasing a targeted employment area (TEA), which might provide particular benefits. Recognizing these qualifications is important to steering the EB-5 visa procedure effectively.

Financial Investment Amounts Required

Qualification for the EB-5 visa program hinges significantly on the investment quantities called for, which are readied to guarantee that international capitalists contribute meaningfully to the united state economic situation. Since the current guidelines, the minimum investment needed is $1 million. Nevertheless, this quantity is minimized to $800,000 if the financial investment is made in a targeted work area (TEA), which is typically a backwoods or one with high joblessness prices.

These financial investment amounts are vital as they are designed to boost task development and economic development within the USA. Each EB-5 financier is required to demonstrate that their financial investment will develop or protect at the very least 10 permanent work for united state employees within two years of the financier's admission to the country.

Furthermore, it is important for investors to perform complete due diligence when picking a project, as the potential for job creation and the total viability of the investment directly influence the success of their application. Comprehending these financial needs is a fundamental action in guiding via the EB-5 visa process and protecting a pathway to long-term residency in the U.S.

Investment Options

When considering investment options for the EB-5 program, it is vital to recognize the numerous sorts of investments offered. Financiers have to likewise analyze the connected dangers, ensuring an educated choice that aligns with their financial objectives. This discussion will certainly check out both the sorts of financial investments and effective risk analysis methods.

Kinds of Investments

The landscape of EB-5 financial investments uses a selection of alternatives tailored to satisfy the varied objectives of potential financiers. At its core, the EB-5 program allows individuals to buy brand-new industrial ventures that will certainly maintain or create at the very least 10 full time tasks for certifying U.S. workers.

Alternatively, capitalists can select direct financial investments in their own business ventures. This route needs an extra hands-on technique and straight participation in managing the enterprise, permitting higher control over the investment.

Additionally, capitalists can take into consideration traditional financial investments in approved jobs that meet the EB-5 standards. These can vary from making centers to friendliness developments, each with prospective returns and distinct offerings.

Eventually, the option of investment must line up with the capitalist's financial objectives, danger tolerance, and level of preferred participation, allowing them to accomplish visa needs while going after growth possibilities in the united state economic climate.

Threat Analysis Approaches

Effective threat examination strategies are crucial for EB-5 capitalists looking for to navigate the complexities of financial investment choices. Reviewing the feasibility of an investment calls for a detailed understanding of both the economic landscape and the particular task in inquiry. Financiers need to begin by conducting due persistance on the Regional Facility or project enroller, inspecting their performance history, economic stability, and conformity with EB-5 policies.

In addition, it is important to analyze the marketplace problems pertinent to the financial investment. Assessing the regional economy, sector trends, and competition can offer insights into prospective risks and returns. Capitalists ought to likewise take into consideration the job's task development capacity, as this is a crucial demand for EB-5 visa eligibility.

Diversity can minimize dangers related to individual financial investments. By spreading out resources throughout numerous tasks or fields, financiers can decrease the influence of a single investment's underperformance. Involving with knowledgeable legal and financial consultants can help navigate intricate policies and recognize red flags that might not be instantly obvious.

The Regional Facility Program

Designed to promote economic development and job development in targeted locations, the Regional Center Program is a crucial element of the EB-5 visa effort. Established by the U.S. Citizenship and Migration Provider (USCIS), this program allows capitalists to pool their resources right into designated Regional Centers, which are entities authorized to assist in financial investment projects that satisfy details financial standards.

The main goal of the program is to preserve or create a minimum of ten permanent work for united state workers per capitalist. Regional Centers usually concentrate on financially troubled areas, consequently improving local economic situations while offering a pathway to permanent residency for foreign financiers. By spending a minimum of $800,000 in a targeted work area (TEA) or $1,050,000 in a non-TEA, investors can add to diverse jobs, including realty developments, infrastructure improvements, and other service ventures.

Furthermore, financial investments through Regional Centers typically include a decreased burden of direct work production requirements, as the work production can be indirect or caused. This versatility makes the Regional Center Program an eye-catching choice for lots of international nationals seeking to obtain an U.S. visa via financial investment.

Application Process

Guiding via the application procedure for an EB-5 visa includes several vital actions that potential capitalists need to comply with to assure compliance with united state immigration policies. The very first step is to determine a proper EB-5 task, preferably via an assigned local center, ensuring it fulfills the financial investment and job creation requirements.

As soon as a project is selected, capitalists need to prepare the needed paperwork, that includes proof of the source of funds, a thorough service plan, and legal arrangements connected to the financial investment. This phase is important as it establishes the legitimacy of the financial investment and its positioning with EB-5 standards.

Following record preparation, financiers must complete Kind I-526, the Immigrant Request by Alien Investor. This type calls for extensive details regarding the investment and the capitalist's credentials. Once sent, the request undergoes evaluation by united state Citizenship and Migration Provider (USCIS)

Upon approval of the I-526 petition, financiers can proceed to use for their conditional visa. This stage entails sending added kinds and participating in a meeting, where the financier needs to demonstrate their intent blog here to meet the financial investment needs and create the requisite jobs. Each of these actions is essential for a successful EB-5 visa.

Timeline and Processing

Navigating the timeline and handling for the EB-5 visa can be complex, as various factors influence the period of each phase. Normally, the procedure begins with the submission of Kind I-526, the Immigrant Application by Alien Investor. This initial petition can take anywhere from six months to over two years for approval, depending upon the service facility's workload and the specifics of the financial investment job.

As soon as the I-526 petition is approved, investors might make an application for conditional permanent residency through Kind I-485, or if outside the united state, they may go with consular handling. This step can take an additional 6 months to a year. Upon receiving conditional residency, investors must fulfill the investment and job development requirements within the two-year duration.

Benefits of the EB-5 Visa

The EB-5 visa uses a pathway to permanent residency for international financiers, providing them with considerable advantages past just migration (EB-5 Visa by Investment). Among the key advantages is the opportunity for financiers and their instant relative to acquire united state permits, providing them the right to live, function, and study in the USA without limitations

On top of that, the EB-5 program boosts task production and economic growth in the united state, as it calls for capitalists to produce or protect at least ten permanent tasks for American employees. This not only benefits the economic situation yet additionally boosts the financier's neighborhood standing.

Moreover, the EB-5 visa is one-of-a-kind because it does not need a details organization history or prior experience in the united state market, allowing a more comprehensive variety of people to participate. Investors can also appreciate a fairly expedited course to citizenship after preserving their permanent residency for 5 years.

Often Asked Questions

Can I Include My Family Members in My EB-5 Application?

Yes, you can consist of instant family participants-- such as your partner and unmarried children under 21-- in your EB-5 application. This addition permits them to profit from the immigrant investor program along with you.

What Happens if My Investment Fails?

If your investment stops working, you may not satisfy the EB-5 program requirements, resulting in the possible loss of your visa eligibility. It's important to perform thorough due persistance before spending to reduce threats effectively.

Exist Age Restrictions for EB-5 Investors?

There are no details age limitations for EB-5 investors. Nevertheless, candidates need to demonstrate that they meet the investment needs and follow laws, no matter their age, making certain eligibility for the visa procedure.

Can I Obtain Citizenship After Getting the Visa?

Yes, after obtaining a visa, you may get united state citizenship via naturalization. Usually, you should preserve irreversible resident standing for a minimum of five years, demonstrating great ethical personality and meeting other demands.

Is There a Limit on the Number of EB-5 Visas Issued Each Year?

Yes, there is an annual restriction on EB-5 visas. Currently, the program assigns 10,000 visas each , with added stipulations for household members of investors, which can affect total availability and handling times.

The EB-5 Visa program offers a compelling method for foreign investors seeking United state permanent residency via tactical financial investments that boost job development. To certify for the EB-5 Visa, investors need to fulfill details certifications and stick to prescribed investment amounts - EB-5 Investment Amount. It is important for investors to verify that their financial investment aligns with the EB-5 program's financial and geographical requirements, particularly if investing in a targeted employment location (TEA), which might provide specific benefits. Qualification for the EB-5 visa program hinges considerably on the financial investment quantities required, which are set to ensure that foreign investors contribute meaningfully to the United state economic situation. Adhering to file prep work, capitalists must finish Form I-526, the Immigrant Petition by Alien Investor